The City of Colwood is committed to sound financial management and is required by legislation to present a balanced budget every spring.

Like any business or household, the needs and expectations of a municipality are often greater than what can be afforded at one time. Difficult choices must be made based on the priorities of the community and Council. The goal is to deliver a high level of service that strikes a balance between household prosperity and city-building initiatives that will improve quality of life while optimizing our tax base.

How are budget decisions made?

Colwood's Official Community Plan sets out the community's vision, goals, and objectives. At the beginning of each term, Council creates a Strategic Plan that identifies areas that require attention. All this gets built into Service Plans for each program area and the Service Plans are reviewed annually by Council in order to draft a 5-year Financial Plan.

Frequently Asked Budget Questions

What is the Service Review?

Each fall, staff facilitate a Service Review process to reaffirm Council's service expectations and clarify priorities for the coming year. View the complete 2024 Service Review Package

What is an operating budget?

The operating budget outlines the City's spending plan to implement Council's goals and priorities based on the Strategic Plan and expectation set in the Service Review. It is based on day-to-day operations of programs and services such as road maintenance, parks, fire rescue and policing. Examples of operating expenses include salaries and wages, insurance, supplies and equipment.

What is a capital budget?

The capital budget outlines expenditures and funding for assets and related programs, such as sewer infrastructure, new roads, bridges, trails and parks.

Does the City access grant funding?

Provincial and federal grants allow the City to deliver on major projects while minimizing impact on property tax.

What charges are included on the tax notice?

Only about half of your tax bill is municipal tax. In 2023, 50% of the charges on a Colwood residential property tax notice are collected for other agencies, such as the Ministry of Education, Capital Regional District, BC Transit and the Hospital Board. All these charges go on one tax notice as an efficient billing process where residents don't have to deal with multiple bills.

2024 Budget process

2024 Budget process

Following the Service Review, a draft financial plan is prepared for review and discussion in a series of public meetings.

Council decisions during Service Review inform budget discussions for the upcoming year.

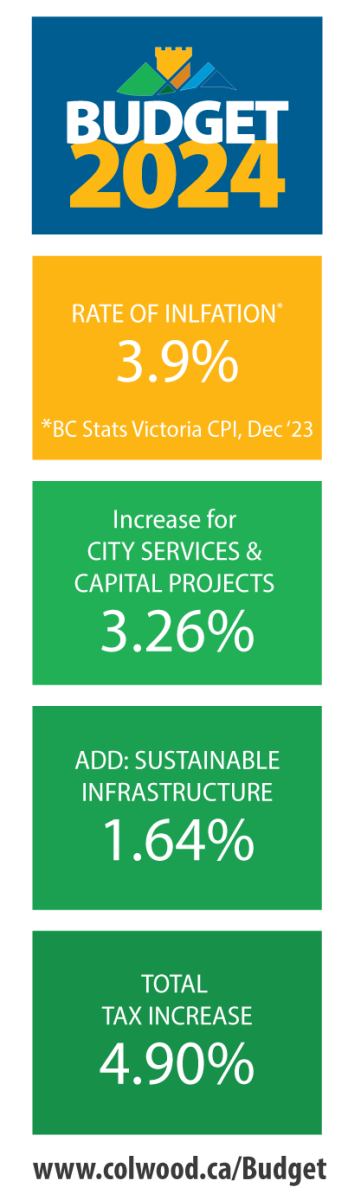

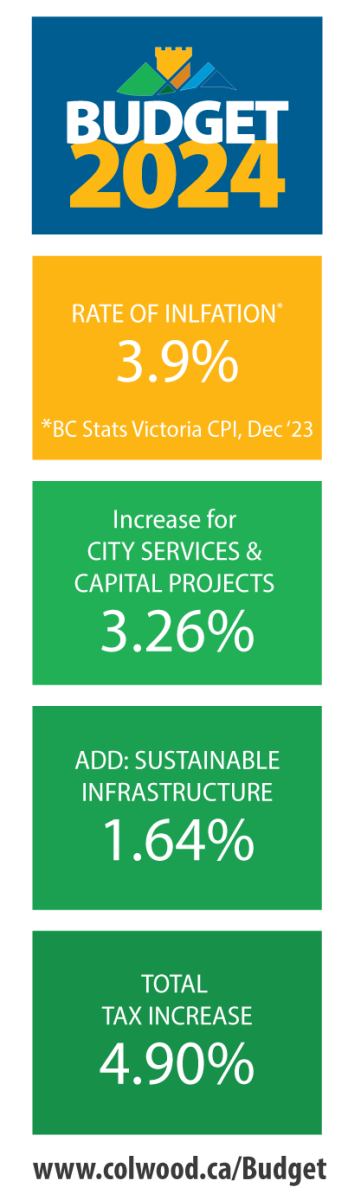

View the draft 2024 - 2028 Financial Plan which received 1st, 2nd, and 3rd reading on February 12, 2024.

The draft Financial Plan details how the City will keep pace with maintenance and repair of expanding infrastructure as well as serving and protecting the safety of a growing number of residents. It also accounts for large capital projects like the waterfront walkway, pedestrian and cycling bridge, sidewalk, cycling intersection and crosswalk improvements, and plans for recreation facilities, public washrooms, and park improvements. Additionally, the Financial Plan includes funds set aside for the maintenance, repair and anticipated replacement of an estimated $350M+ in assets and infrastructure: sewer and storm systems, roads, bridges and other critical assets. This reserve fund plans for the scheduled replacement of aging assets, guards agains sharp tax increases when breakdown occurs, takes advantage of investment returns, and supports community resilience.

Colwood residents are encouraged to attend meetings (see meeting table below) to learn more and provide input. Feedback is also welcome by email to finance@colwood.ca.

| Date | Meeting | Budget Topic |

| Nov 29, 2023 | Service Review | Roads, Storm Sewers, Parks, Trails & Recreation, Boulevards, Sewer Utility and Public Works |

| Dec 4, 2023 | Service Review | Administration & Corporate Services, Human Resources, IT, GIS and Finance |

| Dec 7, 2023 | Service Review | Engineering, Development Services, Community Planning, Communications & Engagement, Events, Arts & Culture |

| Dec 13, 2023 | Service Review | Policing, Fire, Building & Bylaw |

| Jan 9, 2024 | Budget Deliberations | Discussion of Draft 2024 - 2028 Capital Plan |

| Jan 11, 2024 | Budget Discussions | Discussion of Draft 2024 - 2028 Special Initiatives |

| Jan 16, 2024 | Budget Discussions | Financial Plan Introduction |

| Feb 12, 2024 | Council Meeting | Five Year Financial Plan First, Second and Third Reading |

Check the Meeting Calendar for information about all City meetings.

Property tax notices are prepared after the financial plan and tax rate bylaws are adopted by Council. Tax notices are issued near the end of May and tax payments are due on the first business day after July 1st.

Read more about Property Tax.

Colwood Financial Plan and Financial Statements

Find the City's Financial Plan, Sustainable Infrastructure Plan and Financial Statements at www.colwood.ca/FinancialStatements

What is Colwood's overall direction for the future?

The Colwood Official Community Plan outlines the City's vision, goals and objectives based on the input of more than 1400 direct interactions with residents and stakeholders.

Read about Council's Strategic Priorities. Goals for 2019-2023 focus on enhancing Mobility, Prosperity, Governance and Vibrancy.

Additional guiding documents include the Transportation Master Plan, Economic Development Strategy, the Parks & Recreation Master Plan and others. Find them all at Colwood.ca/Plans.

2024 Budget process

2024 Budget process