Each year, on December 31, the British Columbia Assessment Authority (BCAA) mails to each property owner a Property Assessment Notice, which shows the property's market value and other important information about the property. When establishing the market value of a property, BCAA considers many factors including size, layout, age, condition, location, neighbourhood and the value of recent sales of similar properties. Questions regarding property assessments should be directed to BC Assessment.

What should I do with my assessment?

It is important to check all details on the Property Assessment Notice. If you have questions about your property assessment, please call BC Assessment at 1-866-valueBC (1-866-825-8322).

What if I don't agree with my property's assessment?

Property owners have the option of appealing their property tax assessment by the end of January in the year it relates to. Please visit BC Assessment for more information on the appeal process.

Contacting BC Assessment

Toll-Free Number: 1-866-valueBC (825-8322)

Outside North America Number: 604-739-8588

Fax Number: 1-855-995-6209

Contact Form: https://evaluebc.bcassessment.ca/ContactUs.aspx

BC Assessment’s website: http://www.bcassessment.ca/

BC Assessment’s e-valueBC website: https://evaluebc.bcassessment.ca/

BC Assessment’s YouTube channel: https://www.youtube.com/user/BCAssessmentVideos

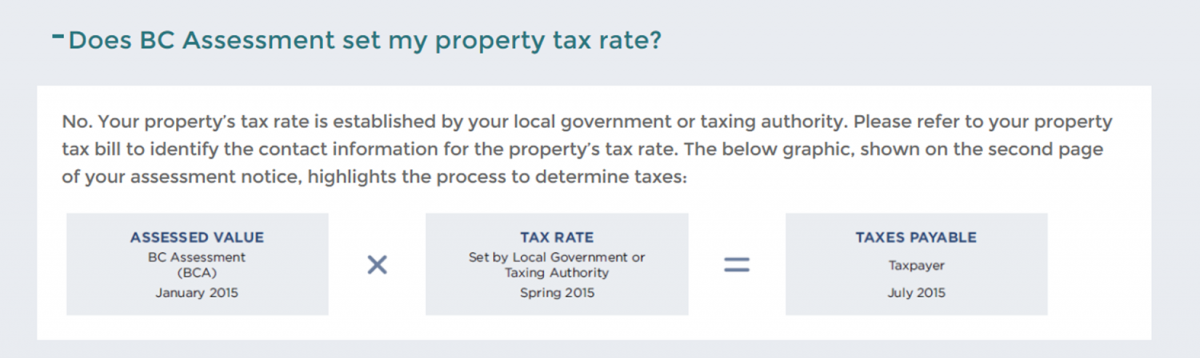

Understanding BC Assessment calculations

BC Assessment's YouTube channel offers videos to help property owners better understand the process.

Understanding Property Assessments & Property Taxes

How Are Property Taxes Calculated

How Are Taxes Calculated if Assessment Values Change

British Columbia Property Assessments by Region