Colwood Council is planning a 0% increase in municipal property tax for 2020. The City will also bring in a five-year phased approach to align Colwood's business tax rates with the regional average, starting in 2020.

Recognizing the financial stress residents and businesses are under, Colwood Council is unanimous in their desire to support the community through this crisis and position the City for a strong economic recovery.

Before the COVID-19 pandemic, Colwood's five-year financial plan proposed a 3.5% tax increase in 2020 to fund service expansions, capital projects and sustainable infrastructure replacement.

To achieve a zero increase in 2020, Council supported shifting some of the service expansions in its five-year financial plan forward several months into 2021.

"Shifting some of the service expansions forward into 2021 allows us to give Colwood taxpayers the relief they need right now," said Mayor Rob Martin.

The revised financial plan includes expanding Colwood's RCMP strength in 2021. "West Shore RCMP does a phenomenal job. Expanding Colwood's RCMP service in 2021 will keep Colwood well ahead of the curve in accelerating police strength to align with population growth over the next 10 to 20 years."

Positioning Colwood businesses for strong economic recovery

Bringing Colwood's business tax rate into a more competitive position in the region will boost the ability of local businesses to rebound quickly while creating a competitive economic environment to attract new businesses to commercial spaces at Colwood Corners, in Royal Bay and in the Allandale District, among others.

The City is also reaching out to business owners directly through surveys and roundtable meetings to better understand the impact COVID-19 is having on their business and how the City can best help position them for successful recovery.

Keeping Colwood residential taxes among the lowest in the region

"Adding to the financial burden residents face at this time is not an option for Colwood Council," said Mayor Rob Martin.

The average Colwood homeowner will not see an increase over their 2019 municipal taxes unless a home's value increased more than the average in the past year.

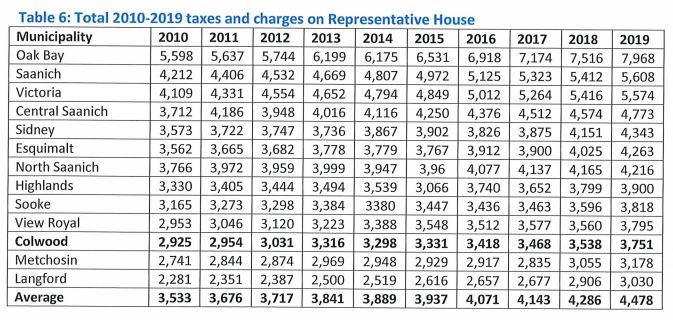

Colwood residential taxes are third lowest in the Capital Region, with a representative house paying $3,751 in 2019, as shown in comparative data table below from the Ministry of Municipal Affairs and Housing.

How will 0% look on property tax bills?

Keep in mind that over half of the charges on your property tax bill are for other agencies over which the City has no direct control: taxes for schools, hospitals, libraries, transit, recreation and Capital Regional District services, among others.

While the City is holding at 0%, other agencies are looking at lifts in 2020, which will impact the total taxes you will pay.

Property value is another factor that affects taxes. BC Assessment explains tthat "The most important factor is not how much YOUR assessed value has changed, but how your assessed value has changed RELATIVE TO THE AVERAGE CHANGE for your property class in your municipality..." You can check property assessments by address at https://www.bcassessment.ca/

Colwood Council is scheduled to review the Five Year Financial Plan Bylaw at their regular meeting on April 27, 2020.