The City of Colwood calculates and prepares all property tax notices each year. Tax notices are issued near the end of May and tax payments are due on the first business day after July 1st.

2023 Property Taxes are due on July 4, 2023.

Claim your Home Owner Grant.

Find Ways to Pay Taxes.

Calculating Property Tax Rates

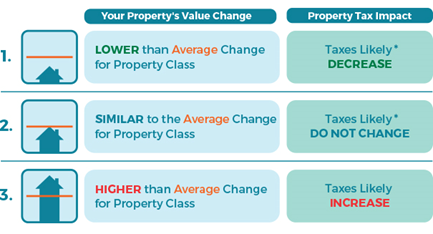

Your property value as determined by BC Assessment is factored into your tax calculation. If your property’s value increased more than the average for Colwood, the municipal portion of your tax bill may increase.

Tax Certificates

Tax Certificates are available for purchase through:

- myLTSA: If you have an account, log in and from the main menu, select Service Providers and Order Tax Certificates. More information about myLTSA and how to become a customer is available on the LTSA website.

- APIC: If you prefer to pay for the tax certificate by credit card, please go to APIC Canada's website to open an account and order your Tax Certificate.

The city cannot provide tax certificate information over the phone.

Where your tax dollars go

Only half of the revenue from property taxes is controlled by the City of Colwood. Funds collected for other government agencies are simply passed on to them. This makes the system more efficient – residents receive a single tax notice rather than having each organization bill separately.

Read more in the 2023 Property Tax Newsletter that will be attached to your tax notice.

Read more in the 2023 Property Tax Newsletter that will be attached to your tax notice.

Approximately 50% of the amount on your tax notice is collected on behalf of other government agencies, including:

- 28% Province of BC and School Districts (Education)

- 7% Capital Regional District (Recycling, Sewage Treatment, Drinking Water)

- 4.1% West Shore Parks & Recreation Society (Sport, Culture and Recreation)

- 3% Capital Regional Hospital District (Health Care)

- 4% BC Transit (Transportation)

- 3% Greater Victoria Public Library (Juan de Fuca Branch)

- 0.8% BC Assessment Authority and Municipal Finance Authority.

Taxes collected by the City fund services such as police and fire protection, street lighting, road and drainage maintenance, operating parks and recreational facilities, and planning and managing city developments and enhancements.

Ways to Pay Your Property Taxes

Property Assessment

Home Owner Grants

Tax Sale Information

Where Your Tax Dollars Go

Frequently Asked Questions

Colwood Financial Plan, Official Community Plan and Strategic Plan

The 2023-2027 Financial Plan outlines the City's goal of delivering a high level of service that strikes a balance between affordability for citizens and community building initiatives that will improve quality of life while expanding our tax base.

Colwood's overall direction for the future is detailed in the Official Community Plan. The new draft Colwood Official Community Plan which reflects input from more than 1400 direct interactions with residents and stakeholders. Read the draft now and learn more about the process at: www.colwood.ca/OCP

Council has set out the City's priorities for the next four years in the 2019-2023 Strategic Plan. They focus on four goal areas: Mobility, Prosperity, Governance and Vibrancy .

Need more information?

Please contact the Colwood Finance Department at finance@colwood.ca or 250-294-8150